georgia ad valorem tax family member

This form contains all critical information about the sale including the model of the vehicle its year of manufacture the actual condition sale price and personal. They are usually administered on state income tax forms and are refundable meaning that the full credit is given even if it exceeds.

Georgia Used Car Sales Tax Fees

Staying in ad valorem tax system.

. These credits are normally a flat dollar amount for each family member and are available only to taxpayers with income below a certain threshold. A 2500 recording fee must accompany all applications. If vehicle currently in ad valorem tax system family member has the option of.

D AD VALOREM TAX C TRANSFEREE By signing this affidavit I acknowledge my relationship with the Transferee as an immediate family member. If a soldier is TDA and heshe would like for their spouse or family member to execute an exemption he or she must give their spouse or family member a. The Georgia trailer bill of sale form T-7 is a vital supplementary document allowing the legalization of a private trailer sale between two Georgia residents or one resident and one non-resident.

Georgia has two concurrent vehicle tax systems as follows. Tax structures in 45 states exacerbate income inequality. Sworn to and subscribed before me this _____ day of _____ _____ Notary Publics.

Members of Georgia National Guard OCGA. Title Ad Valorem Tax TAVT Vehicles purchased March 1 2013 or later with a few exceptions. These values have been modified by annual adjustments that have been much less than the.

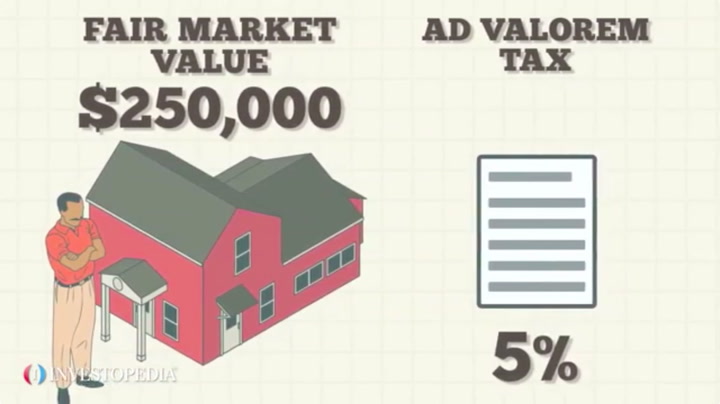

An ad valorem tax is typically imposed at the time of a transaction sales tax or value-added tax VAT but it may be imposed on an annual basis property tax or in connection with another significant event inheritance tax or tariffs. Applications for current use assessment must be filed with the county board of tax assessors on or before the last day for filing ad valorem tax returns in the county April 1. I will pay Title Ad Valorem Tax TAVT for the above vehicle.

40-2-66 For Active Duty Members. In effect Proposition 13 replaced the property tax with a hybrid tax based on a propertys value in 1975 or the date it was last transferred to a non-family member. Owner must be an individual or family farm corporation estate trust or non-profit organization.

Uniform tax valuations used in calculating Title Ad Valorem Tax TAVT and motor vehicle ad valorem taxes are certified to county tax commissioners by the Georgia Department of Revenue. Furnish to that retired member approved documentation supporting the retired members current retired membership status from that reserve unit. In contrast to ad valorem taxation is a per unit tax where the tax base is the quantity of something.

Georgia Department of Revenue - Motor Vehicle Division. Ad Valorem Tax Vehicles purchased February 28 2013 and earlier 2. The adjutant general of Georgia shall upon request of any member of that National Guard unit furnish to that member approved.

7 Steps To Buying A Second Home Re Max Of Ga Remaxga Homebuyer Secondhome Vacationhome Buying First Home Home Buying Tips Home Buying

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

/gettyimages-1299026418-1024x1024-53a7a37a410d4c749c0060f7bcc7f813.jpeg)

Personal Property Tax Definition

How To Find A Georgia Employer Identification Number Property Tax Last Will And Testament Tax

Few Things To Ask The Lawyer Before Hiring Them Law Firm Family Law Family Matters

Your Property Tax Assessment What Does It Mean

Vehicle Taxes Dekalb Tax Commissioner

517 Streamside Pl Canton Ga 30115 Mls 6702580 Coldwell Banker House Styles Coldwell Banker Canton

/getty-moneyhouse_1500_157590565-56a7269c5f9b58b7d0e757e3.jpg)

How To Pay Your Property Tax Bill

For Sale 65 Mosby Woods Dr Newnan Ga 289 900 View Details Map And Photos Of This Single Family Property W Newnan Hydrangea Garden Real Estate Services

Property Tax How To Calculate Local Considerations

A Breakdown Of 2022 Property Tax By State

Pin On Streamline The Systems At Your Dance Studio

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

Lithia Springs Drive In 1984 Douglas County One Wave Lithia Springs

:max_bytes(150000):strip_icc()/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)