cryptocurrency tax calculator australia

Yes you do need to pay tax on cryptocurrency in Australia. Australian tax residents get a little breathing space with a number of tax-free thresholds and allowances that happily apply to crypto too.

11 Best Crypto Tax Calculators To Check Out

Plans Pricing All plans include coverage for every type of crypto transaction including but not limited to DeFi.

. How is crypto tax calculated. Free platform for Australians. Follow these 3 steps to help you manage your tax responsibilities with cryptocurrency.

In this case your tax liability will be calculated as follows. Crypto tax breaks. 0 tax on income up to AU18200.

Toggle menu toggle menu path. The fair market value of the coins you received is taxable eg. The tax year in Australia runs from the 1st of July to the 30th of June the following year.

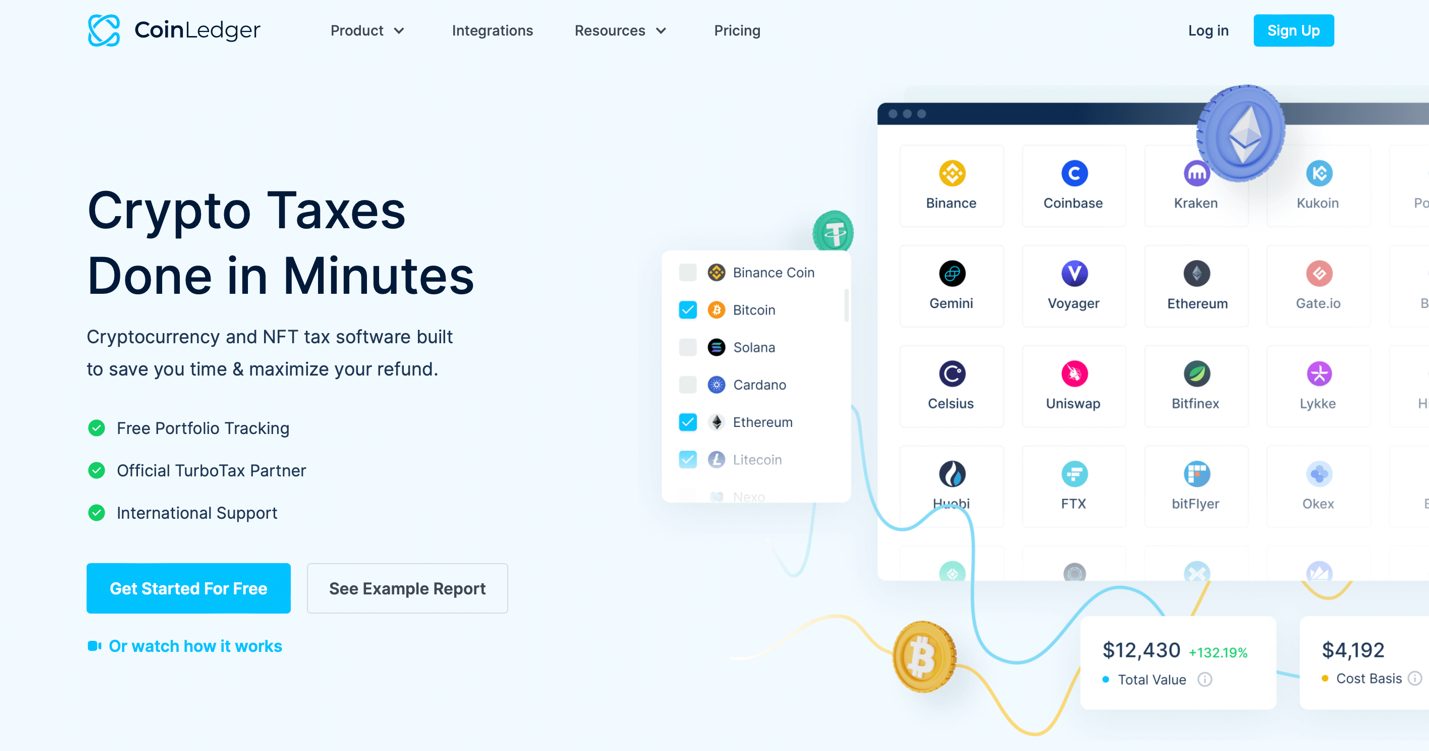

Crypto Trader Tax is one of the most popular cryptocurrency tax calculator platforms on the web. Calculate Your Crypto DeFi and NFT Taxes in as little as 20 minutes. You must report a disposal of cryptocurrency for capital gains tax.

First log into CoinSpot and follow the below steps. Report disposal of cryptocurrency. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included.

The gains from cryptocurrency trading rather than investment will be taxed under income tax and not capital gains tax. TokenTax works as a cryptocurrency tax calculator that connects to every crypto exchange. We suggest you select a country based on your tax jurisdiction.

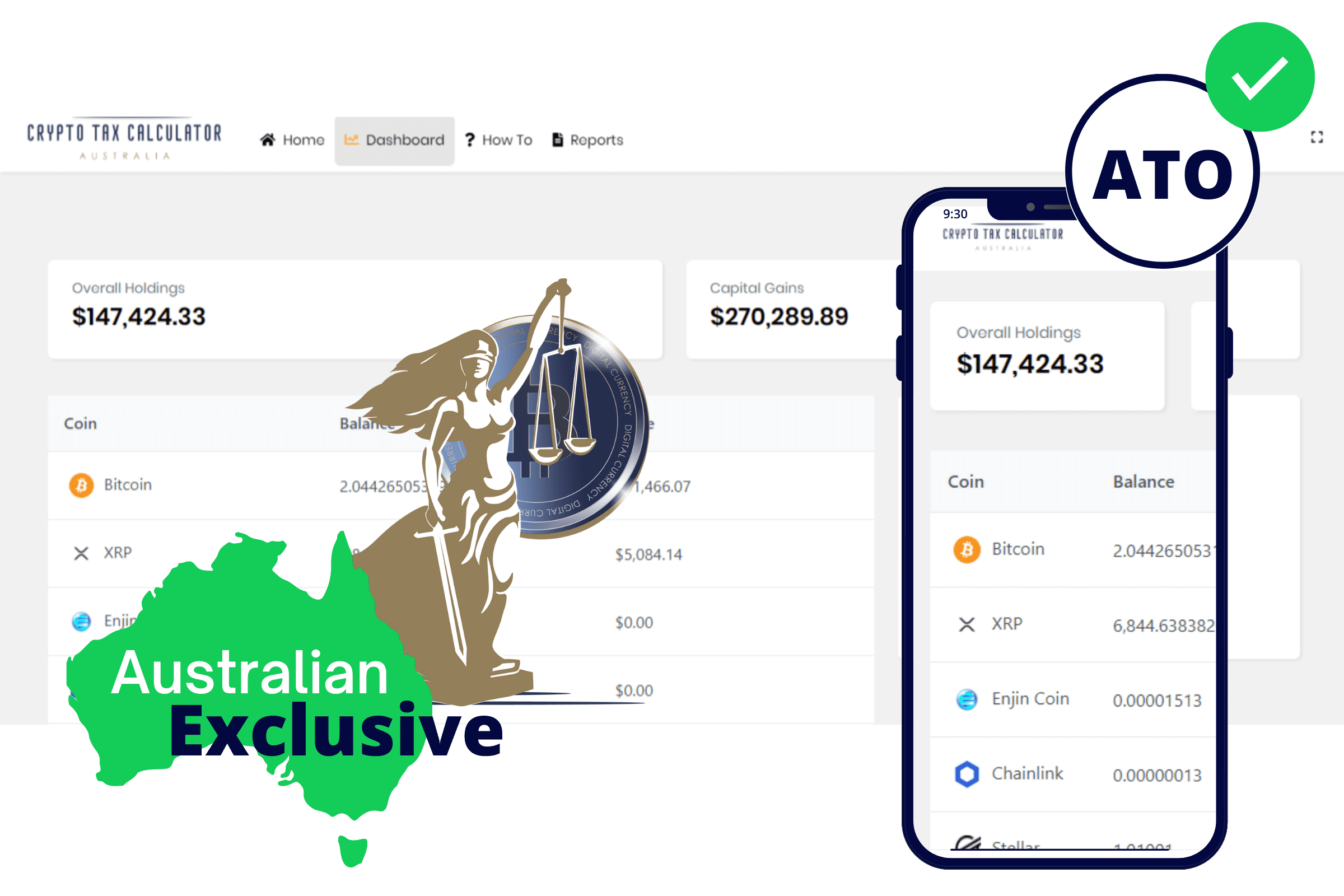

It provides users with an extremely user-friendly app which can be. Crypto Tax Calculator for Australia. The tax you need to pay will.

You can easily download a CSV file from CoinSpot and upload it into CryptoTaxCalculator. 19 tax on income between AU18201 to AU45000 which come to AU5092. Crypto tax deadline in Australia.

Find out how Australian crypto tax works in this detailed guide. Your net capital gain from cryptocurrency is added to your taxable income in the financial year that you sell or otherwise dispose of your crypto. Crypto Tax Calculator for Australia.

Built to comply with Aussie tax standards. TaxBit is a good choice for those who want to automate their crypto tax reporting. Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king.

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. If you are completing your tax return for 20212022. The tax rate on this particular bracket is 325.

It supports all major exchanges and wallets. Upload via a CSV file. There are no limitations on the data source and you can import data from anywhere.

Quick simple and reliable. In the top right corner.

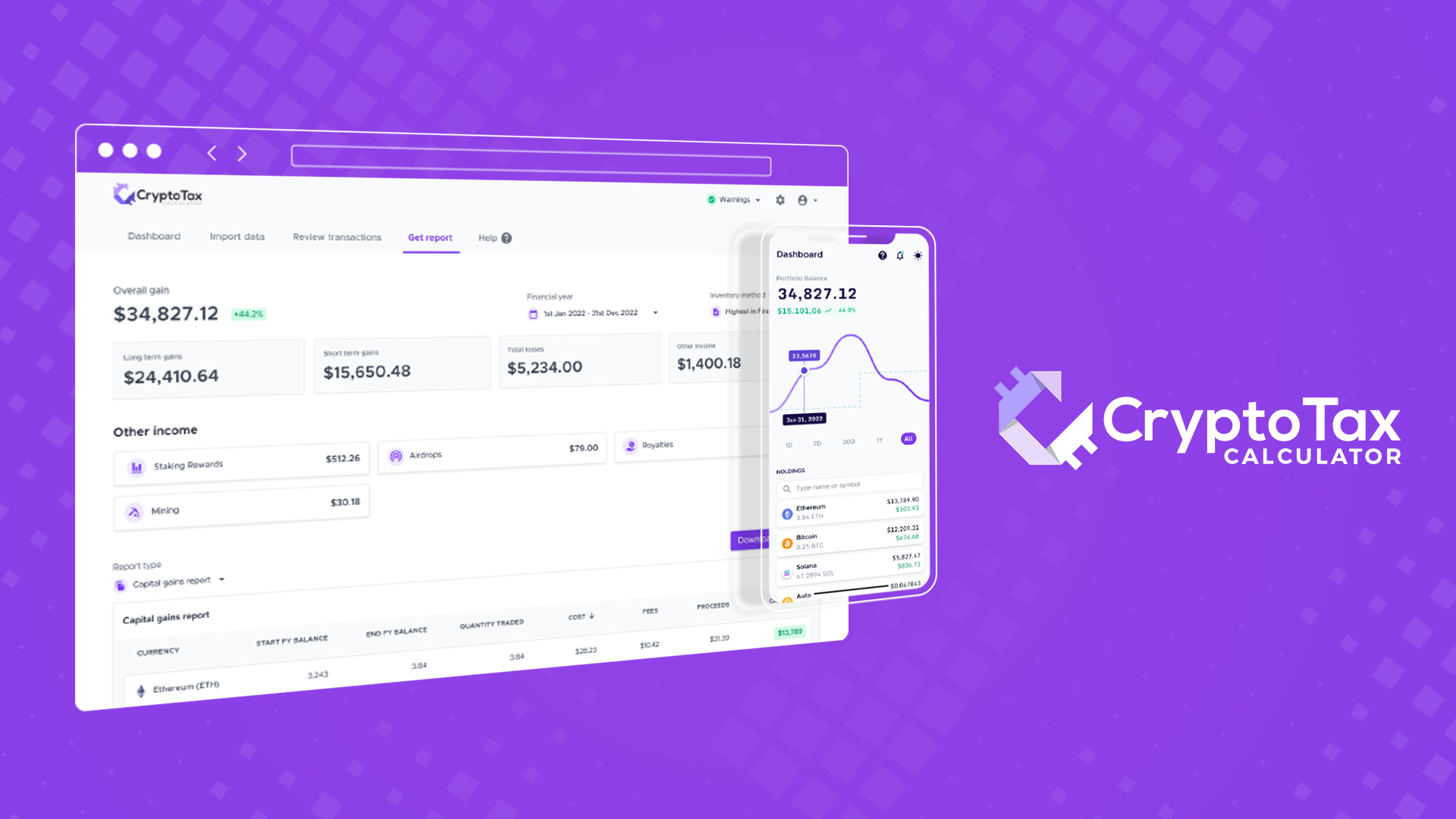

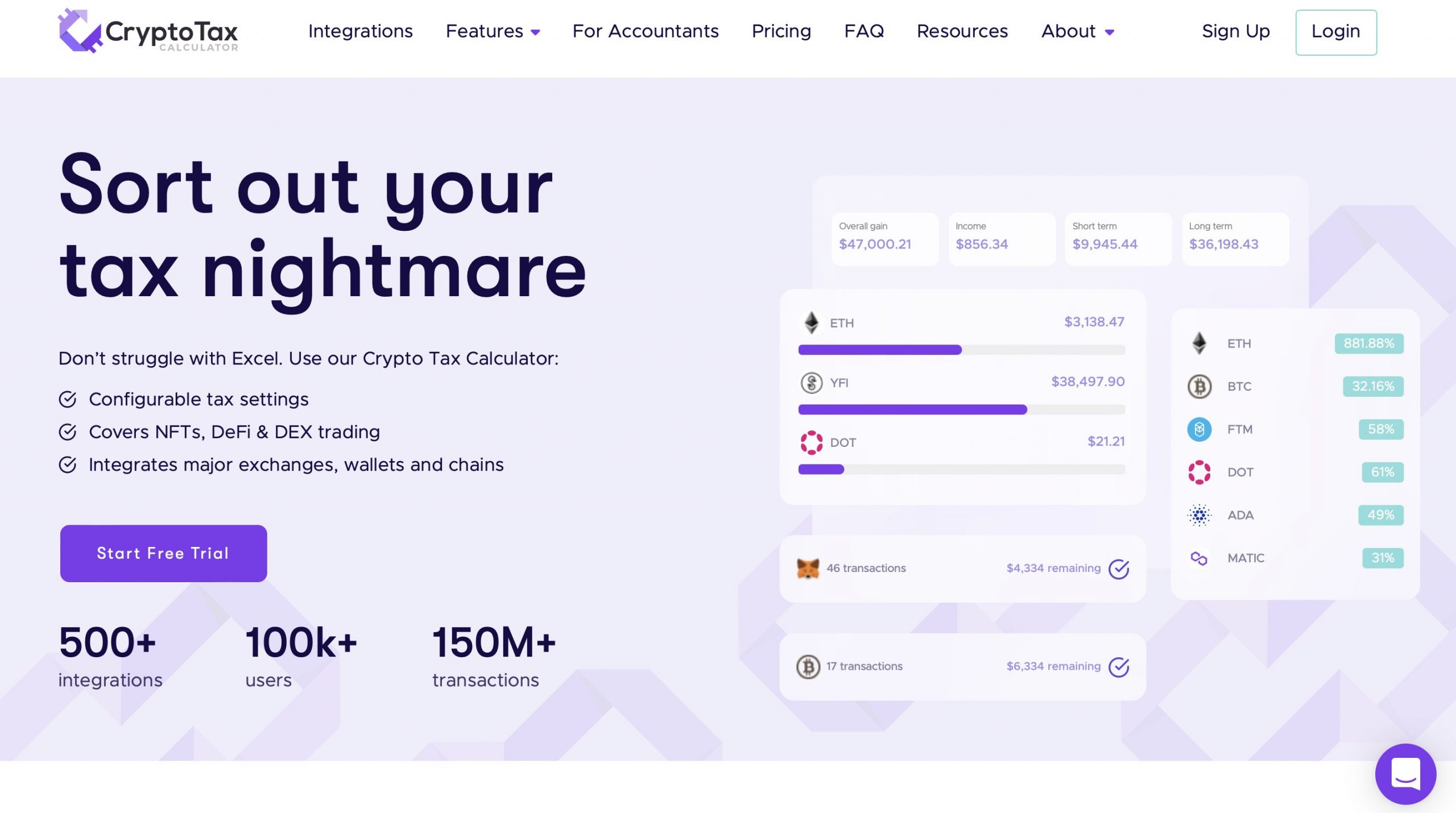

Australia S Cryptotaxcalculator Helps Traders Demystify The Decentralized Techcrunch

11 Best Crypto Tax Calculators To Check Out

Crypto Tax Calculator Overview Youtube

Crypto Tax In Australia The Definitive 2022 Guide

Best Crypto Tax Software Top Solutions For 2022

Capital Gains Tax Calculator Ey Us

Do You Mine Coins Whether Your Mining Is Active Passive Or Hobby Income Depends On How Much Time And Personal Bitcoin Mining Bitcoin What Is Bitcoin Mining

Crypto Tax Calculator Australia 2022 Calculate Profit And Tax For Free Marketplace Fairness

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

How To Calculate Crypto Taxes Koinly

I Highly Recommend Cointracking Info For Cryptocurrency Traders To Stay On Top Of Their Gains And Do More Best Crypto Portfolio Management Best Cryptocurrency

Crypto Tax Calculator Australia Calculate Your Crypto Tax

11 Best Crypto Tax Calculators To Check Out

Calculate Your Crypto Taxes With Ease Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare